If you haven’t come across risk management, you should have realized that the most difficult part of trading is not making money but rather controlling your losses. That’s why we’re going to talk about risk management in the following blog post.

Welcome back to another Humbled Trader trading crash course. Thank you for all the positive support. This risk management crash course is the most valuable lesson that all traders should learn in their trading journey. I will share why you should care about risk management, how risk management can improve your profitability, the process of calculating proper position sizing, risk-reward ratio application, and how to manage risk during a trade. Let’s jump in for more details!

What are the Strategies for Volatile Market Trading?

In a volatile market, managing risk is all about carefully setting your entry and exit points. Make sure to set stop-loss orders to limit potential losses and take-profit orders to secure your profits when the price reaches your target. That’s where risk management comes into play.

Why Should You Care about Risk Management?

From all of my years of trading and teaching new traders, I can tell you that most traders do not have a problem setting the entry orders to buy stocks. Many fast learners like yourself might already know how to spot a pattern and quickly enter a trade when the setup is there.

But the problem is that as soon as they’re in the middle of a trade and when the open P&L starts fluctuating, they tend to black out and forget what they should do next.

Without Proper Risk Management, You’re Going to Break Your Account

Many new traders often fear letting their winning trades run and are hesitant to cut their losing trades. Worse still, they might add more bets to a losing trade, hoping to quickly recover their losses.

If this sounds familiar, rest assured you’re not alone, and it doesn’t necessarily mean you’re a bad trader. You just need to adjust your priorities: Risk management should always take precedence in trading.

How Can Risk Management Improve Your Profitability?

Risk Management Is the Foundation of Trading

If you don’t manage your risk, you’ll never become profitable, especially when you have a small account. Why? Let’s be real here, no one can predict whether a stock is going to go up or down with 100% certainty at any given time.

As traders, we do not have control over the profits we make as we can only profit from what the market gives us. However, we can control how much money we lose. This brings us to the first step of risk management for traders: understanding the power of the risk-reward ratio.

Understanding the Power of Risk-Reward Ratio

As a trader, you might already know what a risk-reward ratio is. Here is a quick recap:

The Risk-Reward Ratio, which compares potential profits to possible losses, aids traders in understanding potential trade outcomes before execution.

Let’s Talk About the Maximum Risk in Trade

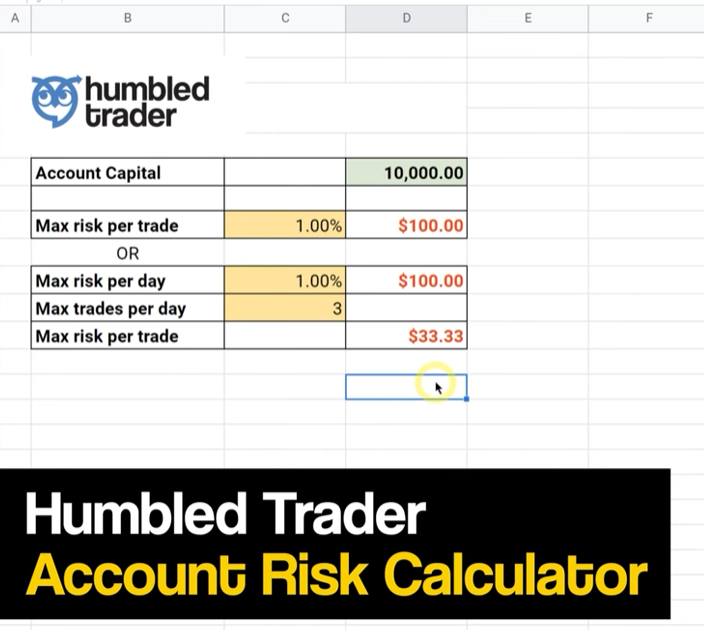

In this example, I’ll show you how to set a proper risk-reward ratio according to your account size using this spreadsheet. Let’s say you have a $10,000 account capital.

Remember the golden rule: You should risk a maximum of 1% per trade.

This means if you have a $10,000 account, you’re risking $100 for each trade.

However, if you’re more conservative and prefer to risk just $100 per day, you can do so. This $100 becomes your maximum daily risk. But if you make multiple trades per day, the amount you risk per trade will vary. For instance, if you make 2 trades per day, you’re allowed to risk $50 per trade.

Whichever method you choose, be consistent. Your maximum risk per trade, or your maximum daily risk, should be a figure you always keep in mind. The goal is to keep this risk amount as constant as possible for every trade you make.

Risk/Reward Ratio With Winning Rate Simulation

In the following examples, you will better understand the risk/reward dynamics under different winning rate simulations.

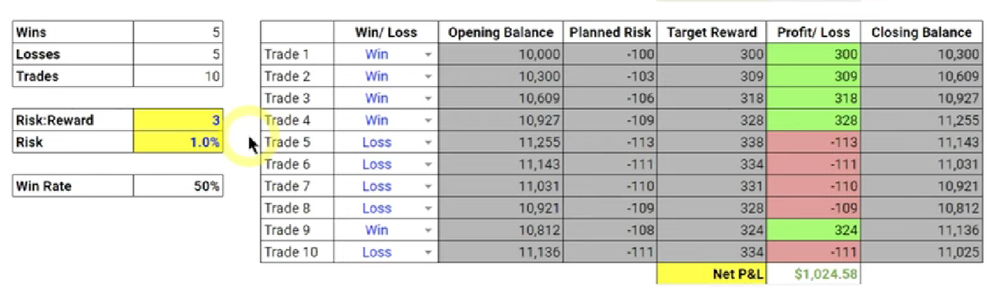

Suppose I’m using the same $10,000 account capital and am still risking 1% of my account size per trade.

A 1:1 Risk-Reward Ratio with a 50% Winning Rate

When I have a risk-reward ratio of 1:1, it means that when I make money, I make $100 (reward), and when I lose the trade, I lose $100 (risk).

If I have a 50% win rate, it means that I make money on 5 out of every 10 trades. Therefore, if I profit from these 5 trades and lose money on the other 5, I essentially break even (without considering the commissions or platform costs).

Essentially, if your risk-reward ratio is 1:1 and you have a 50% win rate, you’re in the red.

A 50% win rate is quite optimistic for new traders. In reality, most new traders likely have a win rate of 40% or less. This is the main reason why many new and struggling traders are unprofitable. They risk the same amount as they stand to gain, leading to difficulties in managing their stops because they may also lack the right strategy to let the trade work out and maximize their profits.

A 1:2 Risk-Reward Ratio with a 50% Winning Rate

In the second scenario, we continue to risk $100 per trade. However, our risk-reward ratio has improved. We’re risking $100 to potentially make $200. Therefore, with a 50% win rate, we could indeed become profitable, reaching $500.

A 1:2 Risk-Reward Ratio with a 40% Winning Rate

Even with a win rate of only 40%, we can still be profitable. This implies that success is not solely reliant on being correct, but also on managing risk effectively. If we lose $100 per trade, we should ensure that our reward is at least 2 times greater than our risk when we make a profitable trade. This should be the minimum goal for a new trader.

But remember, even with only a 40% win rate, profitability is achievable. However, ideally, we should aim for a 50% win rate.

A 1:3 Risk-Reward Ratio with a 50% Winning Rate

With a risk ratio of 1:2, traders with small accounts need a higher risk-reward ratio for substantial growth. Ideally, a ratio of 1:3 or more is favorable. In this scenario, the risk is still $100, but with effective risk management, losses are limited to $100. However, when profits are made, they are three times more, amounting to $300. Therefore, even with a 50% win rate, you can become quite profitable. As you can see, with only a 50% win rate on 10 trades, you’re still gaining $1,000.

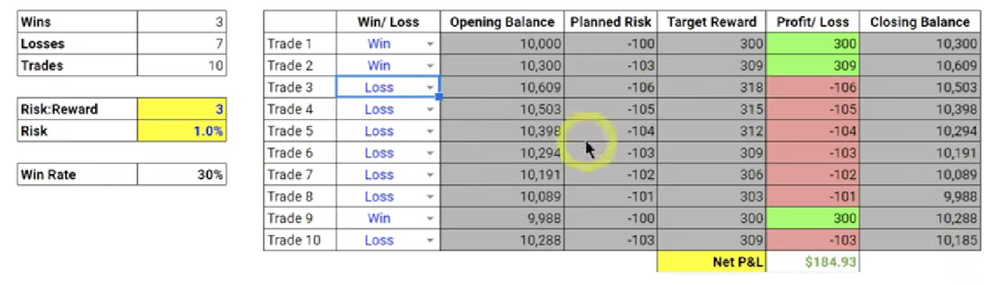

A 1:3 Risk-Reward Ratio with a 30% Winning Rate

Now, consider a scenario where my win rate is only 30%. Even with this low win rate, if I’m effective at maximizing my profits and limiting my risk to only $100, I can still remain profitable.

Trader Ideal Goal: 1:3 Risk-Reward Ratio with a 60-70% Winning Rate

However, the true magic occurs when you maintain an average win rate of around 60% to 70%. Most traders find this range to be very profitable, especially when paired with a minimum risk-reward ratio of 1:2, though ideally, it should be 1:3.

Golden Rule: Keep Your Risk Constant

If you’re trading with a smaller account of $1,000, your risk should only be $10. If you’re trading with $5,000, your risk should only be $50. Remember, as your account grows, the amount you’re risking will increase, but the percentage should remain constant. This risk management strategy ensures your risk is proportionate to your account size, preventing you from risking too much of your capital.

The Process of Calculating Proper Position Sizing

Risk-Reward Ratio Application

Step 0: Draw all the support and resistance on your charts.Step 1: Identify potential loss areas using the daily key support/resistance level.Step 2: Determine potential targets with support/resistance levels.Step 3: Calculate the risk/reward ratio, ensuring it’s at least 1:2.Step 4: Calculate the maximum trade risk with the 1% rule (Total capital x 1% = Maximum risk per trade/maximum risk per day).

How to Manage Risk During a Trade

This is the most advanced part of the whole lesson. You are going to learn active trade management: how to manage your risk during a trade. Here is how you can do it:

Set at least two profit targets. If the price reaches these targets, raise your stop loss to your entry price to mitigate risk. This means that if the price returns to your entry price, you won’t incur any loss. You can even set the stop loss higher than the entry price to secure a small gain.

A simple example here to show how you can do it:

Entry price: $10Stop loss: $8Target Price: $12 and $14

After entering the trade, monitor the price movement to see if it reaches the $12 target price. If it does, move the stop loss from $8 to $12 to mitigate any loss. Then continue to observe the price, hoping it moves closer to the $14 target.

Tips to Be a Better Trader

To be a better trader, try to avoid the typical beginner trader mistakes:

Overtrading Without a Proper Plan

One of the most common mistakes made by traders, especially those new to the field, is overtrading. This refers to the act of making too many trades, often without a well-thought-out plan. Overtrading can quickly erode your capital and may also lead to poor decision-making, as you may feel compelled to make impulsive trades in an attempt to recoup losses.

To avoid this, it’s essential to have a clear trading plan in place before you start trading. This should include a detailed strategy for each trade, including entry and exit points, risk-reward ratios, and a clear understanding of the market conditions that will indicate when it’s time to make a trade.

Remember, successful trading isn’t about making as many trades as possible; it’s about making the right trades at the right time.

Ignoring Market Trends

Traders often make the mistake of ignoring market trends, instead relying solely on their analysis. While it’s important to have your own trading strategy, it’s equally important to pay attention to broader market trends. These trends can provide valuable insights into potential risks and opportunities, helping you make more informed trading decisions.

Ignoring market trends can be particularly dangerous in volatile markets, as rapid price changes can lead to significant losses if not properly anticipated. Therefore, it’s crucial to stay updated on market trends and adjust your trading strategy accordingly.

Neglecting to Use Stop-Loss Orders

Stop-loss orders are a vital tool in risk management, as they automatically close out a trade at a predetermined price to limit losses. However, some traders neglect to use stop-loss orders, often due to overconfidence in their trading abilities or a desire to avoid “locking in” a loss.

However, not using stop-loss orders can lead to significant losses, especially in a volatile market where prices can change rapidly. By setting a stop-loss order, you can ensure that you exit a losing trade before your losses become too large.

Not Understanding the Power of the Risk-Reward Ratio

The risk-reward ratio is a critical trading concept, comparing potential loss to potential profit. It guides traders in setting stop-loss and take-profit levels, managing trades, and enhancing profitability.

Moreover, maintaining a consistent risk-reward ratio helps in strategic trading, preventing impulsive decisions and focusing on long-term goals.

You Are Your Boss In Trading

You don’t have a boss who’s watching your back; you’re the only person in charge of all the mistakes you make, as well as all the profits. So, if you’re still wondering why trading is so difficult or why you’re losing money while some traders out there have succeeded, then you probably need to come to terms with yourself. You need to work on risk management!

If you’re serious about learning more about day trading and risk management, join our Humbled Trader Community. Here, you’ll find condensed lessons from my over 8 years of trading experience! From beginner to professional level, you can find day-trading knowledge here.

Join the Humbled Trader Community today: Humbled Trader Community

Join the Humbled Trader Community todayDon’t feel like reading? Watch the video.

Permalink